Paying for Care

Receiving the proper care for your mental health condition is essential to your recovery. The best treatments are the ones prescribed by a doctor or mental health practitioner, and that may include counseling, medication, support, diet and exercise, and alternative therapy among others.

Unfortunately, visiting mental health providers and paying for many of these treatments can be expensive. Not all people have access to affordable insurance. Whether you're insured or not, and whether that insurance coverage is adequate, there are ways that you can find help paying for your care.

Much of the health care system in our country depends on health care coverage, which is usually provided by a form of insurance. If you don't have insurance, it can be difficult to pay for treatment unless you are independently wealthy. Consider the options below to obtain coverage; in the meantime see Finding Care to get immediate help.

Obtaining Coverage

You may be able to obtain insurance if you are not currently insured. Here are some options:

Medicaid

Medicaid is health care coverage offered in combination by the federal government and your state government. It helps low-income individuals in certain groups pay for medical care and prescriptions. Medicaid is not a typical insurance program with monthly payments and deductibles; Medicaid pays providers directly for your care. Low-income beneficiaries aren't the only group to receive Medicaid, as there are several other qualified groups that are covered (although some of this will change in upcoming healthcare reform).

In addition to covering those who are low income, Medicaid covers:

- Pregnant women

- Women with children under 6

- Children between the ages of 6-19

- Supplemental Security Income recipients

- Young adults up to age 21 living alone

- People over the age of 65

- Those who are blind or deaf

Many states also have a "medically needy" clause, which means you can receive Medicaid without falling under any of those categories if your state determines that you need the medical treatment and you are under the threshold of the Federal Poverty Level.

Many people with mental illness become eligible for Medicaid by qualifying as disabled, either as children or as adults after age 19. Adults determined to be disabled receive Supplemental Security Income (SSI) from the Social Security Administration. SSI provides a small amount of monthly income To find out if you qualify for SSI, visit http://www.ssa.gov/ssi/text-eligibility-ussi.htm.

Many children can receive Medicaid even if they are not otherwise eligible through their State's Children's Health Insurance Program (SCHIP). SCHIP requirements tend to be broader.

If you believe that you meet the income and eligibility requirements, you can apply for Medicaid. For specific questions about eligibility for Medicaid in your state, you should call your state office. For more information on Medicaid, click here.

Medicare

Medicare, like Medicaid, is a health coverage plan run by the federal government. Medicare operates more like traditionally funded health insurance than Medicaid. Unlike Medicaid, Medicare is a federal program (without state differences) and is geared toward people based on age or disability status and not income. To enroll for Medicare, you must have received social security disability benefits (SSDI) for at least two years.

Medicare mimics a private insurance plan and has deductibles and co-pays. Medicare is structured into four parts, and you may be eligible for one or more of the parts.

- Part A - Medicare Part A deals with hospitalization and inpatient services.

- Part B - Medicare Part B deals with outpatient services and routine medical care.

- Part C - Medicare Part C or Medicare Advantage is a way to extend benefits of A,B, and D

- Part D - Medicare Part D deals with drugs. People with very low income get extra help paying for the prescription costs and deductibles in Part D.

Coverage under Family Insurance

You may be eligible for coverage under your parents' insurance plan if you are under the age of 26 due to new changes in the healthcare reform law. If you had previously been removed from coverage upon reaching age 22, you can re-enter the plan until you reach 26.

Employer Coverage

If you are employed, your company may offer health insurance as a benefit package. Employers may pay some or all of the monthly payments or premiums for your package. Employer plans tend to be more expensive and comprehensive than those on the individual market and frequently do not discriminate on the basis of pre-existing conditions. Often, employers who do not pay any part of your health insurance may still have a company plan that you can opt to enroll in.

COBRA

If you have recently lost your job, you may be eligible to keep your health insurance at a cost to you through the Consolidated Omnibus Business Reconciliation Act (COBRA). COBRA allows you to keep your health insurance for a specified period of time as long as you continue to pay the premiums.

School

If you are attending a state university as an undergraduate student, your state may offer a healthcare plan for you. Large schools and universities may have their own clinics or teaching hospitals. Some schools may offer programs for graduate students.

Private Insurance

If you are not able to obtain insurance coverage through family, work or school and you are not eligible for government insurance, you can consider buying insurance on the private market. Private insurance can be expensive, and you will need to evaluate your plan very closely.

There are several terms you will need to know before shopping for insurance:

Primary Care Physician - In many managed care plans or health maintenance organizations, you will have to choose a primary care physician, also sometimes called a general practitioner. Primary care physicians typically specialize in Internal Medicine or Pediatrics. Your primary care physician is the main doctor you will see for most of your ailments that don't require urgent care. If you want to see a specialist, you may need a referral from a primary care physician.

Specialist - A specialist is a doctor such as an allergist, a gynecologist, or a podiatrist who specializes in treating one or more similar conditions or specializes in a specific age or gender group. Specialists may be able to run more tests and diagnose more problems than a primary care physician.

Referral - A referral is an authorization from your primary care physician to see a specialist or another doctor. It does not mean your insurance company will cover the cost.

Pre-approval - A pre-approval is when your insurance company "OKs" paying for a treatment before you take it.

Network - Insurance companies will typically list doctors or facilities as "in network" or "out of network." Anyone who is "in network" has a pre-existing arrangement with your insurance company for how much can be billed and paid by the company. Out-of-network practitioners do not have a relationship with your insurance company; they may cost you more.

You will have to pick what kind of plan you want when you are shopping for insurance. There are several different structures of plans:

- A managed care plan, though often the most affordable, is the strictest when it comes to choosing your doctors. In a managed care plan, you may receive all of your services from pre-determined doctors or facilities. You might always have to go to Facility A to see your primary care physician and receive a referral before you can see a specialist chosen by your plan who also works in Facility A, and you may have to get all of your prescriptions at the same facility.

- A health maintenance organization is similar to a managed care plan, but instead of your doctors being chosen for you, you will have a choice as long as you remain "in network."

- A point of service plan is similar to a health maintenance organization, but you may not need to visit a primary care physician for referrals to specialists as long as you stay within the network.

- A preferred provider organization (PPO) plan is the broadest type of plan, where you never need to see a specialist. You can go both in and out of network, but in-network care is cheapest.

There are several kinds of expenses involved when you are shopping for insurance.

- A premium is a monthly payment that you make to buy into the insurance,.

- A co-pay is any payment you make out of pocket when you visit a doctor or buy medication. For example, you may have to pay $20 when you visit your primary care physician and $40 when you visit a specialist.

- A deductible is the total amount you will have to pay out of pocket before your insurance coverage activates (although routine visits for general health may be excluded from this deductible). For example, you may have a deductible of $5,000. So if you are hospitalized and it costs $10,000, you will have to pay $5,000 before your insurance company will make payments on your behalf.

- A cap is the final amount that an insurance company will pay on your behalf either per year or over your lifetime, although this is going away. For example, you might have an annual cap of $100,000 and a lifetime cap of $1,000,000.

Generally, the higher the premiums are, the lower the deductible. Private insurance may also be more discriminatory than employer plans based on pre-existing conditions (although this is going away) and other statuses that affect your health (such as smoking or age). You may be able to find cheaper private insurance if you look for incentive-based plans that charge lower premiums for people who actively work to eliminate health risks such as smoking and obesity.

There are also some other things to watch out for:

A pre-existing condition is a health condition you have before you applied for insurance, such as major depression. Before the passage of the health care reform law, insurance companies could deny you based on a pre-existing condition, give you a very high premium and/or deductible because of your condition, or agree to cover any illnesses except those related to your pre-existing condition. This will change as health care reform goes into effect.

Your insurance will have a list of covered conditions and procedures. You should always read this to make sure your plan is comprehensive. Insurance companies can refuse to cover certain diagnoses and treatments not on the list.

If you are applying for insurance or you can't find affordable health coverage, there are a number of ways that you can still get care. You should never be turned away from a hospital if you are having a medical emergency, regardless of your ability to pay.

Free Clinics are non-profit organizations that perform medical safety net services for free or at a highly reduced cost.

Free Clinics provide safety net services, which are intended to help people who are ineligible for Medicaid and Medicare but can't find affordable health insurance. They are often found in hospitals or as stand-alone facilities in densely populated areas of poverty. Some, but not all, free clinics provide mental health services in addition to preventative general health and maintenance.

Generally, free clinics will perform services for free, charge a nominal fee ($15/visit, for example), or initiate a sliding scale fee based on your income. , When visiting a free clinic, you may need to take your identification, as well as proof of income, such as a prior year's W2 form. Some clinics may take walk-in clients on a daily basis; others are more like doctor's offices that you will have to join.

Community Mental Health Centers offer low-cost or free care on a sliding scale to the public. Typical services include emergency services, therapy and psychiatric care for adults and for children. You can expect to go through an intake interview that determines the kind of care you will receive. Mental health centers also may offer a variety of services on a long-term basis for clients with persistent mental health conditions. Find your local mental health center by contacting your local government.

Local Nonprofits that aren't specifically designated as health clinics may still have therapists, psychologists, or psychiatrists who donate their time and agree to see patients for free or at a reduced cost. Many groups will organize professionals who will donate some time each week or month to see patients. These professionals will often meet at drop-in centers or other clinics.

Even if community mental health centers or local nonprofits don't have a pro bono program, they may know of other resources available to you in your community.

Medical Schools may provide another way of finding help. Students and interns may meet with clients at a highly reduced rate, if you are comfortable seeing them. These students will be under the supervision of a licensed professional.

If you are interested in finding supportive services in addition to professional counseling look for these options in your community:

Hotlines and Warmlines provide immediate support by telephone for people in emotional crisis and people with mental health conditions. Where hotlines provide emergency support and crisis intervention, warmlines provide assistance, comfort and referral services. Hotlines and warmlines can be lifesaving, they provide referral to help and care, and they are comforting because they are anonymous and easily accessible by telephone.

Drop-in Centers are organizations that are generally run by people with mental health conditions for their peers. A safe, accepting place to go for company and support. Drop-in centers may organize activities such as support groups or trainings, but they may also be more informal gathering sites.

Support Groups may meet at various places in your community such as churches, schools or government buildings. You can find information about support groups on the Internet, on bulletin boards at local mental health centers and restaurants, or by asking other people with similar conditions. Some support groups also meet anonymously on the Internet, posting on forums or using e-mail to stay in touch. Support groups should either be free or should have a very low cost to cover food or activities ($5 a meeting).

Find a support group here.

The American Self-Help Clearinghouse (https://www.mhselfhelp.org/) and the National Mental Health Consumers' Self-Help Clearinghouse (http://www.mhselfhelp.org/) maintain listings of support groups on a broad range of mental health topics. The National Mental Health Consumers' Self-Help Group Clearinghouse also maintains a Directory of Consumer-Driven Services (http://www.cdsdirectory.org/) that includes peer-run organizations throughout the United States that offer a variety of supportive services and activities.

The ongoing cost of prescription medications can be a challenge, especially if you are taking more than one prescribed medication.

Some pharmaceutical companies offer prescription assistance programs to individuals and families with financial needs. These programs typically require a doctor's consent and proof of your financial status. They may also require that you have either no health insurance or no prescription drug benefit through your health insurance.

In addition, there are county, state, and national prescription programs for which you may qualify and special drug discount cards offered by some pharmaceutical companies.

The Partnership for Prescription Assistance can help qualifying patients without prescription drug coverage get the medicines they need through the program that is right for them. Many will get their medications free or nearly free. For more information, visit http://www.pparx.org/ or call 1-888-477-2669.

It is important to let your doctor know if you cannot afford your prescriptions. In some cases, they may be able to give you free samples of your medications. Discuss with your doctor if switching to generic drugs or less expensive brand-name prescription drugs is a safe option for you.

When a doctor determines that a brand name medication is medically necessary for you or if you are seeking a generic that is identical to the brand but you have trouble affording the higher cost of the brand name medication, a third option may be available. This third option is an authorized generic. An authorized generic medication is a medication made by the original creator of the drug, using the exact same formula (including inactive ingredients) as the original drug. It is manufactured by the maker of the brand name medication and distributed by a special generics division of the drug company. An authorized generic medication will cost the same as a generic medication. But you may have to specially request it from your pharmacy because they may not keep it in stock. Not all medications are available in authorized generic form, but you can check to see if yours is at http://www.authorizedgenericmedicines.org/product-finder.

Another way to cut costs is to compare the prices of your prescription drugs at different retail pharmacies (CVS vs Walgreens vs Walmart, etc.). Many retail pharmacies list their prices for commonly prescribed drugs online. You can also call local pharmacies to request prices for your medications.

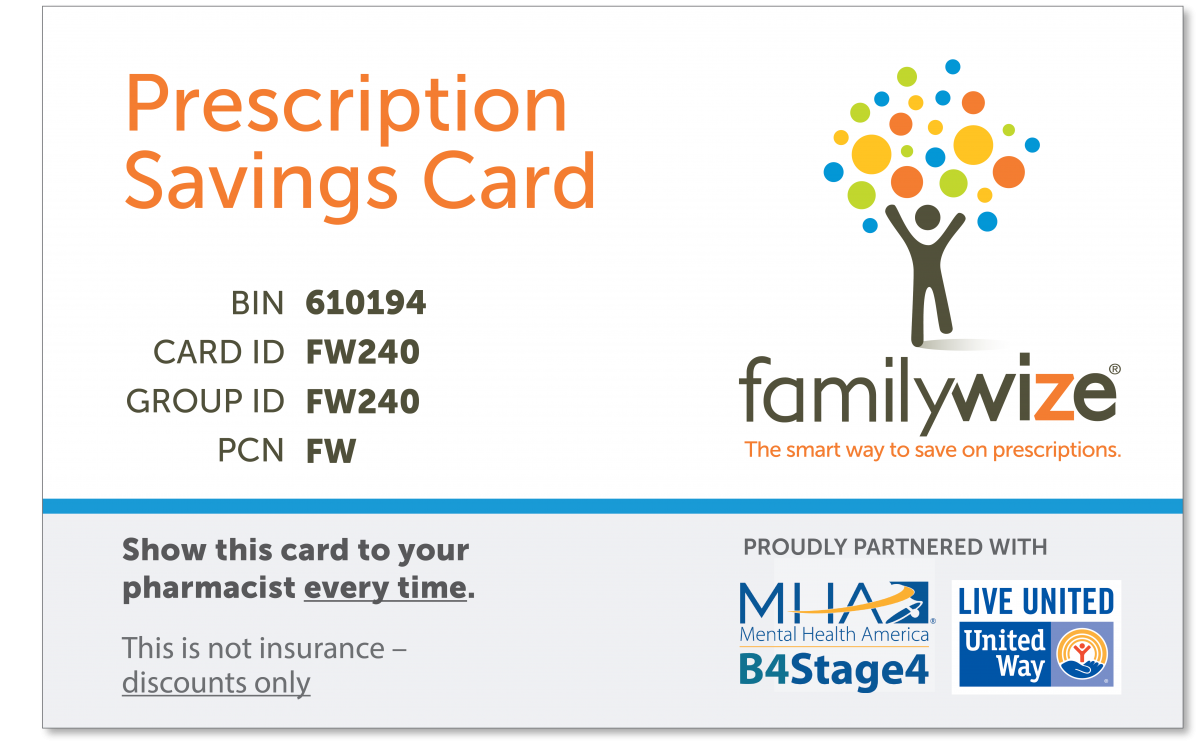

Consider using a prescription savings card such as FamilyWize as another way to cut costs. FamilyWize, a trusted MHA partner, is a community service partnership focused on enabling everyone, both insured and uninsured, to have access to more affordable medications.

The FamilyWize Prescription Discount Card:

- Is FREE for all

- Has no eligibility requirements

- Gives you discounts on your meds, whether you have insurance or not

- Saves you an average of 54% on mental health medications

Download a free card and learn more about FamilyWize here.

Medicare prescription drug coverage, also referred to as Part D, is a program that helps individuals who receive Medicare benefits pay for prescription drugs. This program covers both brand name and generic prescription drugs at participating pharmacies in your area. Everyone on Medicare is eligible, regardless of income, health status, or current prescription expenses.

There are two types of insurance plans that vary in cost and drugs covered:

- Medicare Prescription Drug Plans, sometimes called "PDPs" only offer the Medicare drug benefit.

- Medicare Advantage Plans, sometimes called "MA-PDs," are managed care plans (like HMOs and PPOs) that offer more comprehensive health care coverage, to which the drug benefit will be added.

Extra Help is a program that helps eligible people with Medicare pay for some or most of their prescription drug costs. To learn more about Extra Help, visit https://www.medicare.gov/your-medicare-costs/get-help-paying-costs/find-your-level-of-extra-help-part-d.

For more information on Medicare Part D visit http://www.medicare.gov/part-d/.

Want to find and compare Medicare drug plans or enroll? Visit http://www.medicare.gov/Default.aspx.

Dealing with insurance plans can be challenging, especially when you are already stressed and worried about mental health issues you or a loved one are experiencing. For this reason, it is best to understand your benefits before you need to use them, if at all possible. The following are steps you can take to make sure you understand your benefits so that you can do whatever is within your control to have your treatment covered.

Reviewing Your Insurance Policy

The first thing to find out is what mental health benefits your insurance policy offers. Review your insurance policy so that you are clear about whether your policy includes coverage for mental health services, types of services that are covered and the amount paid for these services, and any steps you must take to have treatment covered. You should have received a copy of your insurance policy when you enrolled in the program, whether at work or independently. If you did not receive a copy of the policy or have lost yours, you can call your insurance company and ask for another one to be sent to you.

Even if you have a copy of the plan, it is always helpful to speak to someone else and clarify questions. This way you can identify any possible points of confusion before you receive a bill. You should have a number on your card or on the website that will tell you whom to contact.

The following are some questions you will want to ask your insurance company, if possible, before starting treatment:

1) Do I need a referral from my primary care physician to a mental health professional?

Many insurance companies, especially Health Maintenance Organizations (HMOs) require referrals from a primary care physician to visit any specialist, including mental health professionals. If you do not receive a referral before visiting a mental health professional, your insurance company may deny your claims. If you think you require a referral, you should always get it in advance.

2) Do I need any pre-approval from the insurance company before I see a mental health professional?

A referral is an authorization from a doctor saying that the treatment is medically necessary; pre-approval or pre-authorization requires that your insurance company agrees to make the payment. You should call your insurance company to see if you need pre-approval, but you should also keep other questions in mind-how many visits are you approved for? Do you need a new approval for each visit? If you are going to be hospitalized or in inpatient care, how many days are you allowed to stay?

3) Do I need to see a mental health professional who is on a list provided by my insurance company (in a "network") or am I free to choose any qualified professional?

If you need an "in network" provider, you can usually find a directory online or ask your primary care physician to help pick someone out.

4) Does the amount paid by my insurance company depend on whether I see a professional who is "in their network or preferred provider list" or "outside the network"? If so, what is the difference in the amount paid or percent reimbursement for "in network" vs. "out of network" providers?

"In network" providers are almost always cheaper than "out of network" providers, although whether you want to save money or visit a doctor you prefer is a choice you will have to make. Bear in mind that your insurance company may not always have a flat difference. For some companies, seeing an "in network" provider may cost you a $20 co-pay, and an "out of network" provider will cost you $30; in others, "in network" may cost you $20 and an "out of network" may cost you 20% - which could be significantly higher than $30.

5) Are there dollar limits, visit limits or other coverage limits for my mental health benefits? Is there a difference in what is paid for outpatient vs. inpatient treatment? If so, what are my benefits for each of these?

It is not uncommon, based on your state and your plan, to have limits on psychiatric visits or medication management visits. Your plan may limit you to something like 25 sessions with a psychiatrist each year, up to 7 days of inpatient treatment a year, and 12 medication management visits a year. If you exceed these services, you will have to pay out of pocket.

6) Is there a specific list of diagnoses for which services are covered? If so, is my diagnosis one of those covered by my policy?

Insurance companies often have the option to not include certain diagnoses in all policies. If you applied with your condition as a pre-existing condition, they may not cover anything related to that. Your insurance company will provide you with a list of covered and uncovered diagnoses.

7) What prescription benefit does my policy offer? What are the co-pays for medications? Are there different levels of prescription coverage depending on the specific medication? Do co-payments vary depending on whether the medication is generic or name brand?

Not all health insurance plans offer a prescription benefit plan in addition to a treatment plan. Even if you have a prescription plan, not all medications are covered. Many prescription plans have "formularies" that determine how much you pay for different classes or brands of drugs. Covered medications fall into three categories:

- Generic: These drugs are copies of brand-name drugs that have been on the market for a number of years and are often offered at very cheap prices.

- Preferred: These drugs are name brand but are available to you at a price below the retail price.

- Non-Preferred: These drugs are name brand but are not offered at a very large discount.

Insurance companies regularly update their formularies to classify drugs under certain payment categories. It's best to ask your doctor to help you find out what payment category your drug is in before you go to the pharmacy to avoid an unpleasant surprise when the bill arrives.

However, many prescription medications for mental health conditions are very expensive and even with health insurance, you can find yourself paying a lot for a prescription.

Mail Order Pharmacy - Some insurance plans will allow you to order a three- month supply of maintenance drugs through the mail for a reduced, standard price.

Seek Outside Assistance - Go here to find out other ways to help pay for your prescription medication.

Seeking Help in Understanding Your Policy

If you have trouble understanding the policy, see if someone from your doctor's office, your employer, or a trusted friend, can help explain the information.

If you receive health insurance through your employer, you may be able to go to your Human Resources department. If your company is large, you may have a dedicated Benefits Specialist who will be able to help you navigate health care. If you work for a smaller business, you will want to talk to the person who arranged the health care. They may not be able to help and their knowledge may be administrative, but they may help put you in touch with an advocate who can put you on the right track. You may be hesitant to admit to your employer that you need help with a mental health condition, but it is not legal for your employer to fire you over a disability.

If you have private insurance, you can contact your state Insurance Department or state Insurance Commissioner's office (their consumer hotline may be the most helpful) for help in understanding your insurance policy. They can also help you find out whether your company benefits follow the state mental health parity laws (laws that guarantee equal coverage for mental health conditions as for other health conditions), and can assist you in dealing with your insurance company if you are having a problem.

Other Resources

The Center for Consumer Health Choices of Consumers Union has prepared a helpful guidebook "A Consumer Guide to Handling Disputes with your Employer or Private Health Plan". Section 1 "Know your Coverage" and the "Checklist for Diagnosing your Coverage" may be particularly useful. You can complete the checklist once you have spoken with your insurance company. Once completed, the checklist can serve as a handy reference should you need services in the future.

How can I get help paying for my prescriptions?

The ongoing cost of prescription medications can be a challenge, especially if you are taking more than one prescribed medication. Some pharmaceutical companies offer prescription assistance programs to individuals and families with financial needs. These programs typically require a doctor's consent and proof of your financial status. They may also require that you have either no health insurance or no prescription drug benefit through your health insurance.

In addition, there are county, state, and national prescription programs for which you may qualify and special drug discount cards offered by some pharmaceutical companies.

The following organizations may be able to help qualifying patients without prescription drug coverage get the medicines they need:

- The Medicine Assistance Tool can help qualifying patients without prescription drug coverage get the medicines they need through the program that is right for them. Many will get their medications free or nearly free.

Your local and/or state Mental Health America office is a resource for information about state and local prescription assistance programs.

Your state Medicaid office may offer information about prescription assistance and drug discount programs available in your state.

Medicare Rights Center offers information about state and national prescription assistance programs, drug discount cards, mail order and internet discount pharmacies, and prescription drug price comparison web sites. This information is not only for Medicare Part D plan participants but for anyone needing information about help paying for their prescription drugs. Use the "Help Paying for Prescription Drugs" option on the left-hand side of the page to access this information.

RX Hope has program descriptions and downloadable applications for prescription assistance programs for specific medications including psychotropic medications.

RX Assist offers a patient assistance program directory along with information about a variety of programs including drug discount cards, prescription assistance programs for generic medications, programs that help with medication co-pays, programs that provide free and low cost health care, as well as information for Medicare Part D beneficiaries.

Needy Meds has a searchable list of disease-specific assistance programs (primarily for other medical conditions) with program description and contact information (Use link under "Additional Programs" on left-hand side of home page.) Some of these programs provide a broad range of financial assistance including help with other necessary expenses such as utility bills. They also have a list of state sponsored programs which can be accessed from the link under "Government Programs" also on the left-hand side of the home page.

Cutting Costs

It is important to let your doctor know if you cannot afford your prescriptions. In some cases, they may be able to give you free samples of your medications. Discuss with your doctor if switching to generic drugs or less expensive brand-name prescription drugs is a safe option for you.

When a doctor determines that a brand name medication is medically necessary for you or if you are seeking a generic that is identical to the brand but you have trouble affording the higher cost of the brand name medication, a third option may be available. This third option is an authorized generic. An authorized generic medication is a medication made by the original creator of the drug, using the exact same formula (including inactive ingredients) as the original drug. It is manufactured by the maker of the brand name medication and distributed by a special generics division of the drug company. An authorized generic medication will cost the same as a generic medication. But you may have to specially request it from your pharmacy because they may not keep it in stock. Not all medications are available in authorized generic form, but you can check to see if yours is at www.authorizedgenericmedicines.org/product-finder.

Another way to cut costs is to compare the prices of your prescription drugs at different retail pharmacies (CVS vs Walgreens vs Walmart, etc.). Many retail pharmacies list their prices for commonly prescribed drugs online. You can also call local pharmacies to request prices for your medications.

Consider using a prescription savings card such as FamilyWize as another way to cut costs. FamilyWize, a trusted MHA partner, is a community service partnership focused on enabling everyone, both insured and uninsured, to have access to more affordable medications.

The SingleCare Prescription Discount Card:

- Is FREE for all

- Has no eligibility requirements

- Gives you discounts on your meds, whether you have insurance or not

- Saves you an average of 54% on mental health medications

Download a free card and learn more about SingleCare here.

Medicare Part D

Medicare prescription drug coverage, also referred to as Part D, is a program that helps individuals who receive Medicare benefits pay for prescription drugs. This program covers both brand name and generic prescription drugs at participating pharmacies in your area. Everyone on Medicare is eligible, regardless of income, health status, or current prescription expenses.

There are two types of insurance plans that vary in cost and drugs covered. They are:

- Medicare Prescription Drug Plans, sometimes called "PDPs" only offer the Medicare drug benefit.

- Medicare Advantage Plans, sometimes called "MA-PDs," are managed care plans (like HMOs and PPOs) that offer more comprehensive health care coverage, to which the drug benefit will be added.

Extra Help is a program that helps eligible people with Medicare pay for some or most of their prescription drug costs.

Visit Medicare.gov to find and compare Medicare plans or to enroll.

Talk to a Pharmacist

Do you have more questions? MHA has a partnership with Walgreens and together we want to help. Visit their Pharmacy Chat and speak to someone today to get answers to your medication questions.

Other Resources

There are a variety of organizations that offer prescription assistance for medications used to treat specific medical conditions. While these organizations do not offer assistance in covering the cost of psychotropic medications, they may be helpful if you have other health problems. Some of these programs offer financial assistance for those who have insurance but have high co-pays. Some also offer assistance with insurance premiums.

- National Organization for Rare Diseases (NORD) at 1-800-999-NORD

- Patient Services Inc. at 1-800-366-7741

- HealthWell Foundation at 1-800-675-8416

- Patient Access Network Foundation at 1-866-316-7263